Regardless of current market conditions, you’re likely to be able to negotiate on a home purchase if average time on market is 60-90 days are more, which means sellers tend to nail-bite and strongly consider price reductions if they haven’t done any already. Just be realistic and don’t try to over-negotiate!

As you’ll learn in my free home buyer boot camp, the first step is to become pre-qualified so you know what you can afford. Once you’ve done that and you’re aware of what your price range is, you’ll move to the fun part: visiting open houses and checking out listings. It’s super important to look closely at the details of the home you’re most interested in – there are some flaws you can ignore, like outdated appliances and misguided paint choices. But there are others that might be dealbreakers. And if you overlook the wrong ones, your new home can quickly become a money pit.

Here are the 5 most common home-buying dealbreakers worth double-checking:

The Roof

A well-looked after roof will last 30+ years, but a shoddy installation or poor-quality shingles and tiles can mean needing to replace a roof much sooner. Ask the seller how old the roof is, and if the home has gutters inspect them to make sure the drainage systems are in good working order. Look for dry rot—often caused by poor ventilation—which can cause sagging and crumbling. This is especially common in San Diego since we get so little rain. A new roof can run anywhere from $10,000 to $30,000, depending on the size of the home. You may have room to negotiate if the roof hasn’t been maintained and repairs are needed.

Plumbing

These systems are one of the most critical components of a home, and problems may not be immediately evident—although water stains, sagging floors and mildew could point to evidence of leaks. Also consider issues with sewer lines – some sewer lines haven’t been updated for a long time and require snaking to ensure the line is clear and functional. As you look through your dream home in detail, turn on faucets in bathrooms and kitchen to ensure they drain properly and have adequate water pressure. Also check the age, location and condition of the water heater.

Upgrade Factor

Who doesn’t love the idea of adding on and making it your perfect home? First need to know if it’s even possible, especially if you’re looking at a condo. Local zoning restrictions might make upgrades challenging. Find out of the upgrades you want to make are feasible before hiring an architect or structural engineer. You may lose the money you’d spend on that extra room if you’re moving to bigger digs in a few years anyhow. 🙂

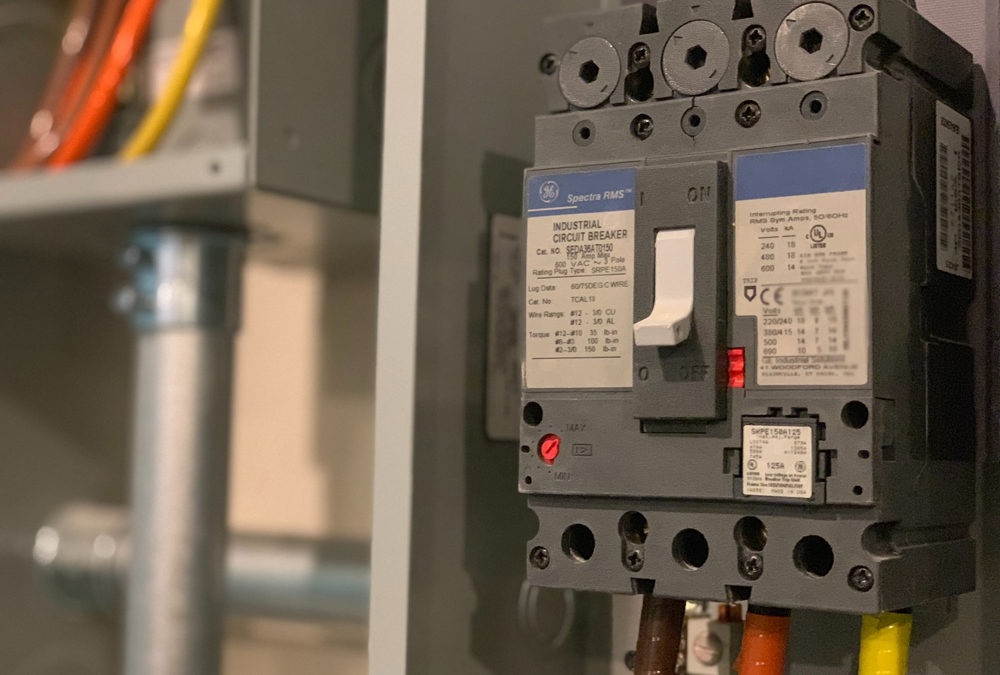

Electrical

It’s fairly common to encounter outdated or inferior electrical work in older homes, especially in San Diego. If the electrical system hasn’t been updated in a few decades, it could be a fire hazard, so be sure to check the main fuse box to make sure it’s in good working order. Also pay attention to any exposed wiring and wires that don’t lead to anything.

House History

Poorly executed renovations, bad plumbing repairs or faulty drywall can haunt a homeowner – even if you weren’t the one who had the work done. As a buyer, don’t ever be shy about asking when repairs were done, whether they were completed by licensed contractors and why the renovations were done in the first place. A disclosure packet is required by the state of California to be compiled by the sellers, which will alert you to recent renovations and repairs, however if the sellers didn’t specify enough detail to satisfy you, probe further. Also, if the house looks freshly renovated it could be a sign that the seller did some sprucing up on the cheap in order to make the house look better to potential buyers.

If the seller has already done a home inspection prior to putting the house on the market, ask to review it. Some states also require disclosure forms, mandating that the seller be up-front about any issues with the home. A qualified real estate agent can guide you through the process, providing specific advice for your area.